massachusetts estate tax return due date

Massachusetts estate tax returns are required if the gross estate plus adjusted taxable gifts computed using the Internal Revenue Code in effect on December 31 2000 exceeds 1000000. The 2020 federal estate tax exemption threshold is 1158 million which means that the estate of an individual who dies in 2020 will only owe estate taxes if its value is greater than that threshold.

Should You Elect The Alternate Valuation Date For Estate Tax

Your estate will only attract the 0 tax rate if its valued at 40000 and below.

. In general if the decedent earned enough income in the final year of life to require filing final income tax returns the final returns for a calendar year taxpayer are due on April 15th following the year of death. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. State Tax Forms.

Due Date of Massachusetts Estate Tax Return Form M-706 Form M-706 Estate Tax Return is due within nine months after the date of the decedents death. An estate valued at 1 million will pay about 36500. 3 However not every estate needs to file Form 706.

For estates of decedents dying in 2006 or after the applicable exclusion amount is 1000000. Estate tax returns must be filed by the. A Team Focused on Bookkeeping and Preparation for Trusts Estates and the Family Office.

Estate tax returns and payments are due 9 months after the date of the decedents death. The Massachusetts estate tax for a resident decedent generally is the Credit for State Death Taxes number shown on Line 15 of the July 1999 Form 706 see Form M-706 Part 1. If youre responsible for the estate of someone who died you may need to file an estate tax return.

As of 2016 if the executor pays at least 80 of the estate tax due before the deadline there will be an automatic 6-month extension to file the. However confusion sets in when the decedent died after the close of the tax year but before the filing of the prior year income. Form 706 must generally be filed along with any tax due within nine months of the decedents date of death.

2006 through the present 1 million. The Massachusetts estate tax is not portable between couples. The Massachusetts estate tax law MGL.

Massachusetts Estate Tax Overview. December 31 2000 see Massachusetts Estate Tax Return Form M-706. The estate tax is a one-time tax due on the value of your taxable estate calculated as of the date of your death.

That is because the attorney or accountant that applied for the ID number may not understand when the tax. Massachusetts estate tax returns are required if the gross estate plus adjusted taxable gifts computed using the Internal Revenue Code in effect. Your estate must file a Massachusetts estate tax return and you may owe Massachusetts estate tax.

This naturally raises the. Legislative leaders plan to extend the states tax filing deadline to May 17 to align with changes at the federal level giving taxpayers more time to. An estate tax is payable by your estate before estate assets are.

Massachusetts uses a graduated tax rate which ranges between 08 and a maximum of 16. A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. When both spouses die only one exemption is applied to the estate.

The Tax Relief Unemployment Insurance Reauthorization and Jobs Creation Act of 2010 which raised the federal exemption from estate taxes to. This means if the value of an estate exceeds the 1 million threshold anything above 40000 will be taxed. The following is the review of Massachusetts estate tax returns.

The date of death and any tax due must be paid at that time. Staple check here language removed from form Form M-4768 Massachusetts Estate Tax Extension Application. The Massachusetts estate tax is calculated by.

Please note that the IRS Notice CP 575 B that assigns an employer ID number tax ID number to the estate will probably say that the Form 1041 is due on April 15. US Estate Tax Return Form 706 Rev. For decedents dying after 2002 the Massachusetts estate tax thresholds varied from year to year as follows.

It depends on the value of the estate. The Massachusetts estate tax is a transfer tax imposed on the value of all property in the estate of a decedent at the date of death and not on the value of property received by each beneficiary. Future changes to the federal estate tax law have no impact on the Massachusetts estate tax.

Only about one in twelve estate income tax returns are due on April 15. As of 2016 if the executor pays at least. The estate tax exemption is 117 million for 2021 and rises to 1206 in 2022.

The Application for Extension of Time to File Massachusetts Estate Tax Return Form M-4768 must be filed prior to the due date for the M-706. Form M-4422 Application for Certificate Releasing Massachusetts Estate Tax Lien and Guidelines. Form 706 July 1999 revision.

Download or print the 2021 Massachusetts Form M-4768 Massachusetts Estate Tax Extension Application for FREE from the Massachusetts Department of Revenue. These additional forms returns apply to certain. Only to be used prior to the due date of the M-706 or on a valid Extension.

Even then only the portion of the estate that exceeds 1158 million will be taxed at a maximum rate of 40. Specifically the person appointed to serve as the personal representative of an estate must file what is known a Massachusetts Estate Tax Return Form M-706 if the gross value of the estate exceeds the applicable exclusion amount in the Internal Revenue Code then in effect and make any necessary tax payment. Specific Information An extension of time to file will be granted automatically for a period of six months.

A Massachusetts estate tax return Form M-706 is required to be filed because the decedents estate exceeds the filing threshold. This is the due date for the filing and payment of the estate tax return. If youre responsible for the estate of someone who died you may need to file an estate tax return.

For other forms in the Form 706 series and for Forms 8892 and 8855 see the related instructions for due date information. A request for an extension of time to pay should be submitted for review. The federal estate tax has a much higher exemption level than the Massachusetts estate tax.

Its worth noting that if at least 80 percent of the tax finally determined to be due is not paid. If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax. File a 2021 calendar year return Form M-990T and pay any tax interest and.

If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax. You can however apply for an extension by submitting Form M-4768. Due Date of Massachusetts Estate Tax Return Form M-706 Form M-706 Estate Tax Return is due within nine months after the date of the decedents death.

If a return is required its due nine months after the date of death. Was enacted in 1975 and is applicable to all estates of decedents dying on or after January 1 1976. The final return for Massachusetts will cover the income received by the decedent up until date of death.

Supplemental forms such as 706-A 706-GS D-1 706-NA or 706-QDT may also need to be filed. The final return is due on or before April 15th of. File a 2021 calendar year return Form M-990T and pay any tax interest and penalties due.

1 The Final Taxes Form 1. The due date for filing the estate tax returns is nine months from the decedents death. Up to 25 cash back Even if a Massachusetts estate tax return must be filed it doesnt necessarily mean that the estate will owe estate tax.

The gift tax return is due on April 15th following the year in which the gift is made. Due Date of Massachusetts Estate Tax Return Form M-706 Form M-706 Estate Tax Return is due within nine months after the date of the decedents death. If the due date is a Saturday Sunday or.

The return must be filed and the tax paid within 9 months from. The estimated amount of tax to be paid found on Line 4 Part 2 of Form M-4768 must be paid in full.

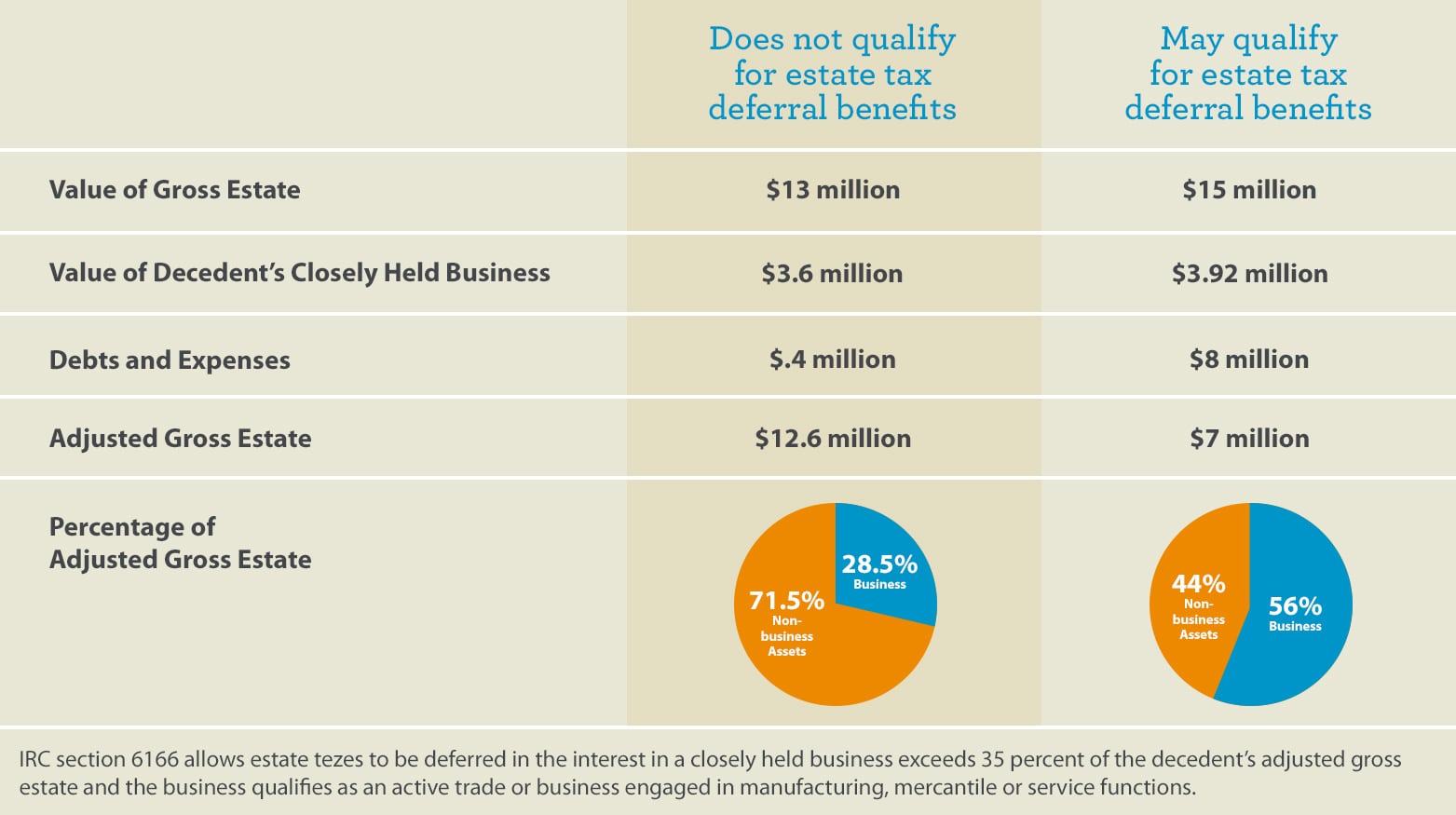

Estate Taxes On A Closely Held Business Under Irc 6166 Wells Fargo Conversations

Estate And Gift Taxes 2021 2022 What S New This Year And What You Need To Know Wsj

:max_bytes(150000):strip_icc()/istock150684235.businessman.executor.black.cropped-5bfc2ed046e0fb0051be72f9.jpg)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Basic Tax Reporting For Decedents And Estates The Cpa Journal

:max_bytes(150000):strip_icc()/184283932-56a044915f9b58eba4af9970.jpg)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

A Guide To Estate Taxes Mass Gov

Louis Vuitton Louis Vuitton Spirit Of Travel Spring 2014 Campaign Treks To South Africa Vuitton Louis Vuitton Peter Lindbergh

Estate Tax Exemption 2021 Amount Goes Up Union Bank

How To Avoid Estate Taxes With Trusts

Inheritance And Estate Settlement When Will I Get My Inheritance The American College Of Trust And Estate Counsel

401 K Inheritance Tax Rules Estate Planning

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Estate And Gift Taxes 2021 2022 What S New This Year And What You Need To Know Wsj

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

A Guide To Estate Taxes Mass Gov

Great Website For Printables Including Printable Ledgers Choose Paper Size And Columns Etc Paper Template Free Accounting School Planner Printables

How Do State Estate And Inheritance Taxes Work Tax Policy Center

:max_bytes(150000):strip_icc()/GettyImages-175427818-430ab4815fd94b2d925edcc40dfaacdd.jpg)